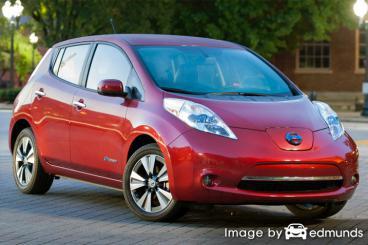

Trying to find the cheapest insurance for your Nissan Leaf in Missouri can normally be a painful process, but you can use a few tricks to find lower rates.

Trying to find the cheapest insurance for your Nissan Leaf in Missouri can normally be a painful process, but you can use a few tricks to find lower rates.

There is a better way to buy insurance and you need to know the absolute fastest way to price shop coverage for a new or used Nissan and find the lowest price from Kansas City insurance agents and online providers.

You need to do rate comparisons before your policy renews since insurance prices are variable and change quite frequently. Just because you found the best price on Nissan Leaf insurance in Kansas City last year you will most likely find a better rate quote today. Forget all the misinformation about insurance because I’m going to let you in on the secrets to the easiest way to eliminate unnecessary coverages and save money on Nissan Leaf insurance in Kansas City.

The companies shown below have been selected to offer free rate quotes in Missouri. To buy the best car insurance in Missouri, we suggest you visit two to three different companies to get the most affordable price.

Insurance is not optional but you don’t have to overpay

Despite the high cost, insurance is a good idea for several reasons.

- Just about all states have minimum liability requirements which means the state requires a minimum amount of liability insurance coverage in order to get the vehicle licensed. In Missouri these limits are 25/50/10 which means you must have $25,000 of bodily injury coverage per person, $50,000 of bodily injury coverage per accident, and $10,000 of property damage coverage.

- If you took out a loan on your Nissan, almost every bank will make it a condition of the loan that you have full coverage to ensure they get paid if you total the vehicle. If you do not pay your insurance premiums, the bank will be required to insure your Nissan at a significantly higher premium and force you to pay a much higher amount than you were paying before.

- Insurance protects not only your car but also your assets. It also can pay for many types of medical costs for you, your passengers, and anyone else injured in an accident. As part of your policy, liability insurance also covers legal expenses if someone files suit against you as the result of an accident. If your Nissan gets damaged, your policy will pay to have it repaired.

The benefits of insuring your car more than offset the price you pay, especially for larger claims. But the average American driver is overpaying over $810 a year so compare rate quotes at every renewal to ensure rates are inline.

How Your Leaf Insurance Rates are Determined

A large part of saving on insurance is knowing the different types of things that come into play when calculating your insurance rates. When consumers understand what determines premiums, this enables informed choices that can earn you big savings.

The items below are some of the items that factor into prices.

Safer vehicles are cheaper to insure – Cars with high safety ratings tend to have better insurance rates. Vehicles built for safety reduce occupant injuries and reduced instances of injuries means less money paid by your insurance company and cheaper rates on your policy.

Obey driving laws and save – Your driving record impacts premiums far more than you think. Just one citation can increase rates to the point where it’s not affordable. Careful drivers have lower premiums than bad drivers. Drivers who get license-revoking violations such as DUI or willful reckless driving may find they need to submit a SR-22 or proof of financial responsibility with their state motor vehicle department in order to prevent a license revocation.

Decrease prices by maintaining coverage – Letting your insurance expire is a sure-fire way to drive up your policy premiums. In addition to paying higher premiums, failure to provide proof of insurance could result in a revoked license or a big fine.

High claims frequency drives up insurance rates – If you frequently file small claims, you can definitely plan on higher premiums or even policy non-renewal. Insurance companies in Missouri award cheaper rates to insureds who do not rely on their insurance for small claims. Auto insurance is intended for the large, substantial claims.

Your spouse saves you money – Having a wife or husband may earn you lower rates on your insurance policy. Marriage generally demonstrates drivers are more mature than a single person and it’s statistically proven that drivers who are married are more cautious.

Safeguard your assets with liability coverage – Your policy’s liability coverage is the coverage that protects you if you are ruled to be at fault for physical damage or personal injury to other. It provides for a legal defense up to the limits shown on your policy. Liability insurance is pretty cheap as compared to coverage for physical damage, so insureds should have plenty of protection for their assets.

Males tend to take more risk – Over the last 30 years, statistics show women are more cautious behind the wheel. Now that doesn’t mean females are better at driving than males. Both genders cause auto accidents at a similar rate, but men tend to have more serious accidents. Men also statistically receive more major tickets like DUI and reckless driving. Teenage male drivers generally have the highest accident percentage and are penalized with high insurance rates.

Is your car, truck or SUV built for speed? – The type of vehicle you own makes a substantial difference in the rate you pay. The lowest performance passenger cars usually have the lowest premiums, but that’s not the only thing that factors into the final price.

Nissan Leaf statistical loss data – Companies take into consideration insurance loss statistics for every vehicle to determine a rate that will be profitable for them. Vehicles that the statistics show to have increased claim numbers or amounts will have higher premium rates. The table below outlines the historical insurance loss data for Nissan Leaf vehicles.

For each insurance policy coverage type, the statistical loss for all vehicles, regardless of make, model or trim level, equals 100. Numbers that are below 100 suggest a positive loss record, while numbers above 100 indicate more frequent losses or a tendency for losses to be larger than average.

| Vehicle Make and Model | Collision | Property Damage | Comp | Personal Injury | Medical Payment | Bodily Injury |

|---|---|---|---|---|---|---|

| Nissan Leaf Electric | 89 | 84 | 45 | 83 | 64 | 76 |

Data Source: Insurance Institute for Highway Safety for 2013-2015 Model Years

You are unique and your insurance should be too

When choosing the right insurance coverage for your vehicles, there really is no single plan that fits everyone. Everyone’s situation is unique and your insurance should unique, too.

For instance, these questions may help highlight if your insurance needs would benefit from professional advice.

- Is a fancy paint job covered?

- Should I have a commercial auto policy?

- How much underlying liability do I need for an umbrella policy?

- When should I remove my kid from my policy?

- When should I not buy collision coverage?

- Does my insurance cover my expensive audio equipment?

- Do I need to file an SR-22 for a DUI in Missouri?

- Do I benefit by insuring my home with the same company?

If you can’t answer these questions, you may need to chat with a licensed insurance agent. To find lower rates from a local agent, simply complete this short form or you can go here for a list of companies in your area. It’s fast, doesn’t cost anything and can help protect your family.

Cheaper auto insurance is a realistic goal

When buying insurance coverage, do not reduce needed coverages to save money. There are too many instances where drivers have reduced liability limits or collision coverage and discovered at claim time that it was a big error on their part. Your focus should be to purchase a proper amount of coverage at the best price, but do not sacrifice coverage to save money.

Some insurance companies do not offer rates over the internet and many times these small insurance companies provide coverage only through local independent agencies. Affordable Nissan Leaf insurance in Kansas City can be found both online and also from your neighborhood Kansas City agents, so you need to compare both in order to have the best price selection to choose from.

We’ve covered a lot of information how to compare Nissan Leaf insurance car insurance rates in Kansas City. The key thing to remember is the more price quotes you have, the more likely it is that you will get a better rate. Consumers could even find that the best car insurance rates are with a lesser-known regional company. These companies may only write in your state and offer lower premium rates than the large multi-state companies such as Allstate and Progressive.

How to find low-cost Nissan Leaf insurance in Kansas City

If saving the most money is your goal, then the best way to quote cheaper Nissan Leaf insurance in Kansas City is to compare prices annually from different companies in Missouri. Rate comparisons can be done by following these steps.

- Spend a few minutes and learn about what coverages are included in your policy and the factors you can control to keep rates low. Many things that result in higher rates such as accidents, careless driving, and a not-so-good credit history can be rectified by improving your driving habits or financial responsibility.

- Compare price quotes from independent agents, exclusive agents, and direct companies. Direct companies and exclusive agencies can only quote rates from one company like Progressive and State Farm, while independent agencies can quote rates for many different companies. Compare rates now

- Compare the new rates to your existing coverage and determine if there is any savings. If you find a lower rate, make sure the effective date of the new policy is the same as the expiration date of the old one.

The most important part of this process is that you use identical deductibles and limits on every quote request and and to get rates from as many auto insurance providers as possible. This guarantees an apples-to-apples comparison and a good representation of prices.

To read more, take a look at these articles:

- Child Safety Seats (Insurance Information Institute)

- What is the Best Auto Insurance in Kansas City, Missouri? (FAQ)

- What Insurance is Cheapest for Low Mileage Drivers in Kansas City? (FAQ)

- How Much is Kansas City Auto Insurance for a Honda Civic? (FAQ)

- How Much are Kansas City Car Insurance Quotes for Veterans? (FAQ)

- Choosing a Car for Your Teen (State Farm)

- Should I Buy a New or Used Car? (Allstate)

- Prom Night Tips for Teen Drivers (State Farm)